YouTools.in

100% Free YouTube Keyword Tool Online & Automation YT Generator to Save Time on Trending Keyword Research

Best YouTube Channels for Stock Market Insights: In-Depth Analysis

Table of Contents

Investing in the stock market is no longer limited to institutional players. With easy access to trading platforms and financial literacy tools, individual investors have entered the market at an unprecedented rate. One of the most popular resources for financial education is YouTube, which offers easy-to-digest content from experts around the world. But with countless channels available, how do you know which ones deliver the best value?

This article analyzes some of the best YouTube channels for stock market insights, covering metrics such as subscriber count, video frequency, and niche expertise. Each channel serves a different type of audience—whether you are a beginner or an advanced trader.

1. Graham Stephan

- Subscribers: 5.2 million

- Content Type: Personal finance, market updates, investment tips

- Video Frequency: 3-5 times a week

Graham Stephan, a former real estate agent turned YouTuber, has built a massive following by focusing on personal finance and stock market investing. While his primary focus lies in long-term investments, Stephan frequently covers stock market trends, analysis of major companies, and how macroeconomic factors affect portfolios.

Strengths:

- Beginner-friendly content

- Covers stocks in the context of overall financial planning

However, his videos may not be suitable for those looking for in-depth technical analysis.

2. Meet Kevin

- Subscribers: 1.9 million

- Content Type: Stock market analysis, economic news, investing strategies

- Video Frequency: Daily

Meet Kevin offers rapid-fire updates on the stock market, often posting multiple videos per day. His content is known for breaking news analysis, including Federal Reserve meetings and stock movements. This makes it a great choice for traders who prefer staying updated with the latest news.

Metrics to Watch:

- Daily View Count: ~500K (for major videos)

- Engagement Rate: 5.6% (comments + likes)

Strengths:

- Timely updates on stock market movements

- Engaging personality that keeps viewers hooked

However, Meet Kevin’s content can feel overwhelming to beginners since he assumes a moderate level of financial knowledge.

3. Bloomberg Markets and Finance

- Subscribers: 3.3 million

- Content Type: Global market insights, interviews with experts, economic trends

- Video Frequency: Daily

This channel offers a more institutional perspective with expert interviews and in-depth coverage of global markets. Bloomberg’s YouTube content is highly professional and appeals to investors looking for detailed economic analyses and stock market predictions.

Strengths:

- Reliable information from financial experts

- Focuses on macroeconomics as well as individual stocks

However, the channel may not appeal to casual investors as it often assumes a background in economics.

4. The Investor’s Podcast (TIP)

- Subscribers: 630K

- Content Type: Value investing, stock analysis, financial literacy

- Video Frequency: Weekly

TIP is an excellent resource for those interested in value investing strategies inspired by Warren Buffett. The channel provides both stock recommendations and deep dives into market psychology. Additionally, they cover interviews with top investors and discussions on financial books.

Strengths:

- Focuses on value investing principles

- Ideal for long-term investors

However, because of its relatively low video frequency, investors who want frequent updates may need to complement it with other sources.

5. Stock Moe

- Subscribers: 600K

- Content Type: Growth stock recommendations, EV sector focus, crypto analysis

- Video Frequency: Daily

Stock Moe’s channel primarily focuses on growth stocks and the electric vehicle (EV) industry, such as Tesla and Nio. He also dabbles in cryptocurrency predictions. This is a great choice for investors with a higher risk tolerance who want to explore emerging sectors.

Metrics:

- Average Video Length: 10-15 minutes

- Watch Time per Month: ~8 million minutes

Strengths:

- Clear focus on high-growth sectors

- Frequent updates

However, his recommendations can be risky, as many of the stocks he covers are highly volatile.

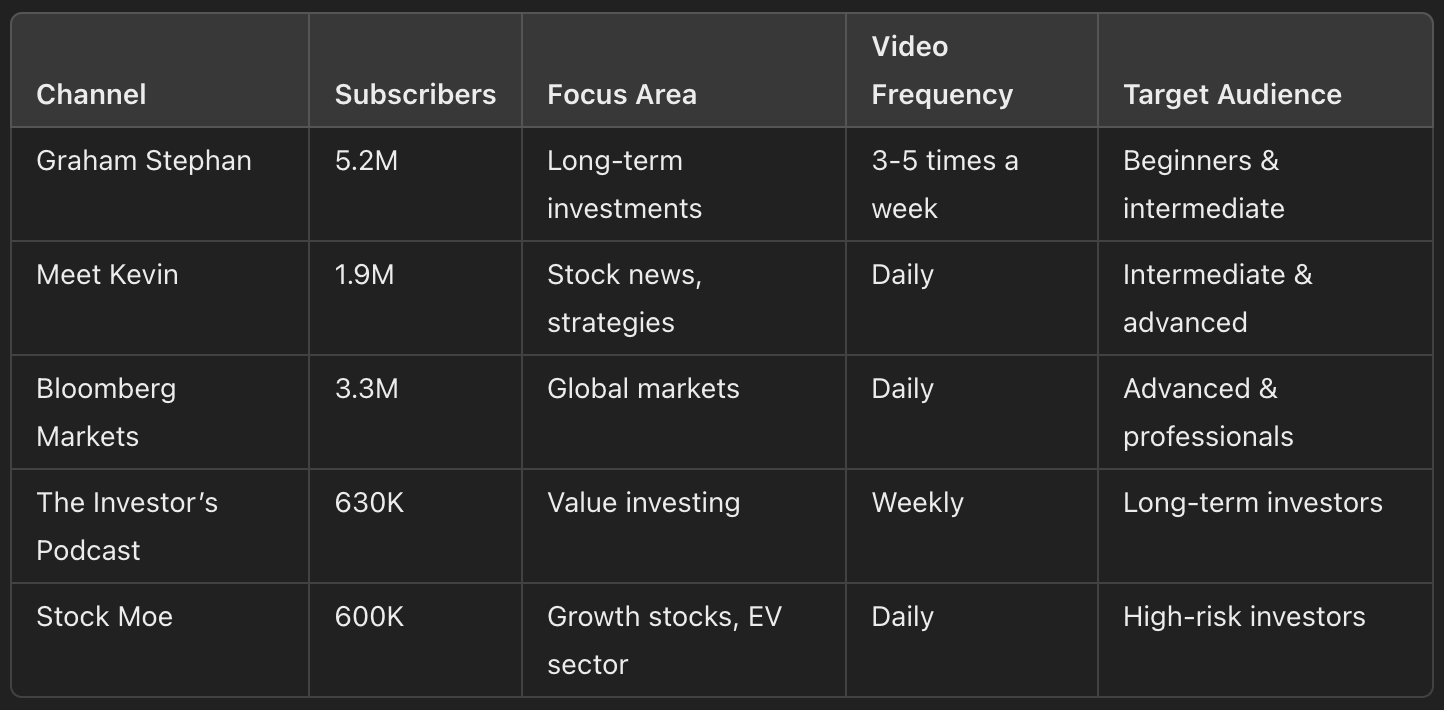

Key Metrics Comparison

Which Channel is Best for You?

Choosing the best YouTube channel for stock market insights depends on your investment goals and experience level:

- For beginners, Graham Stephan is a solid choice due to his accessible explanations and emphasis on financial literacy.

- If you prefer timely updates, Meet Kevin is ideal for staying ahead of market changes.

- For in-depth economic analysis, Bloomberg Markets and Finance provides reliable, expert-driven content.

- Long-term investors will benefit from the value-based principles discussed on The Investor’s Podcast.

- Risk-tolerant investors looking for growth opportunities can explore Stock Moe's recommendations in the EV and crypto space.

By following the right channels, investors can build their knowledge base and make more informed decisions. Remember, the stock market is volatile—staying updated through multiple sources is always recommended.